💡Automatic Pool Rewards Formula

Generate passive income with native tokens and cryptocurrencies

Some Pool Rewards on Danki Finance have a higher yield than others and are proportionately adjusted based on liquidity.

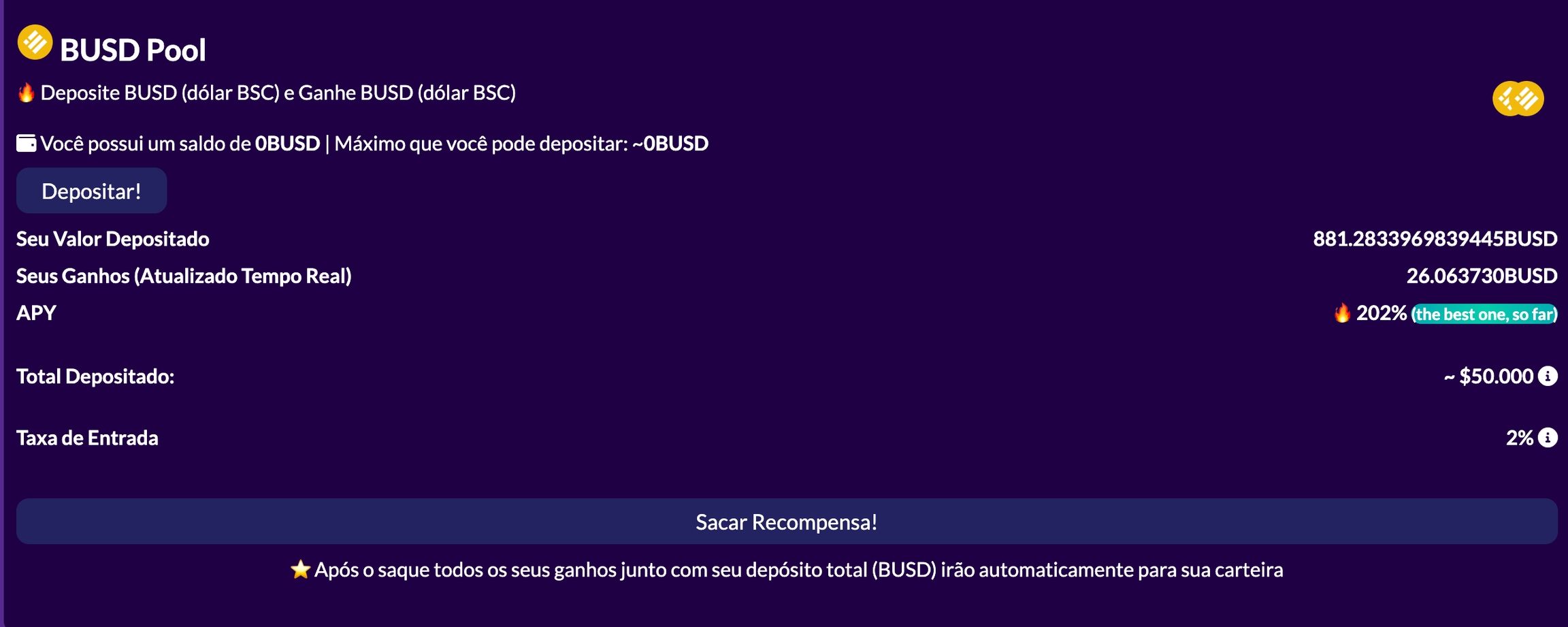

As we can see there are a few more things:

Entrance fee;

Total deposited (estimated);

APY (variable);

This type of Pool is very attractive because the more liquidity added, the higher the APY.

In this way there is an "incentive" for larger participants to enter the Pool and through the formula used in our smart contract the return will be greater (APY).

The formula is done automatically as soon as the APY is adjusted, the yields over the days are also, increasing the daily yield and the values before the readjustment.

If there is an adjustment, rest assured in a short time the income will come back even higher.

The entry fee is charged when you apply the stake. Our contract automatically deducts the proposed amount.

The fee charged goes directly to the company, for the administration of the Pool as well as other services. But most of the time the fee is reinvested in the Pool itself.

The formula used for Pool is similar to those used in DEX (Uniswap, Pancakeswap, DankiSwap etc);

X * Y = K;

K being the "product" of the formula where we must preserve.

Learn more in the Uniswap documentation:

Last updated